Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle®. Available to almost anyone with a U.S.-based bank account. For your protection, Zelle® should only be used for sending money to friends, family, or others you trust. The Request feature within Zelle® is only available through Wells Fargo using a smartphone, and may not be available for use with all small business accounts at this time.

In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®. Neither Wells Fargo nor Zelle® offers a protection program for authorized payments made with Zelle®. To send money to or receive money from an eligible small business, a consumer must be enrolled with Zelle® through their financial institution. Small businesses are not able to enroll in the Zelle® app, and cannot receive payments from consumers enrolled in the Zelle® app. For more information, view the Zelle® Transfer Service Addendum to Wells Fargo's Online Access Agreement. Your mobile carrier's message and data rates may apply.

U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes. The Request feature within Zelle® is only available through Wells Fargo using a smartphone. To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution's online or mobile banking experience.

For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement. Your mobile carrier's message and data rates may apply. Current Terms and Rates 0.01% APY Having a Way2Save® savings account makes saving an easier and more automatic part of your financial habits.

You have to link the account to a Wells Fargo checking account to take advantage of two automatic savings options. Your first option is to use the Save As You Go® transfer program. Your other option is to set up monthly or daily automatic transfers in amounts of your choice. If you're saving monthly, the deposit has to be at least $25, with the daily minimum set at $1.

Cross-selling, the practice underpinning the fraud, is the concept of attempting to sell multiple products to consumers. For instance, a customer with a checking account might be encouraged to take out a mortgage, or set up credit card or online banking account. Success by retail banks was measured in part by the average number of products held by a customer, and Wells Fargo was long considered the most successful cross-seller.

Richard Kovacevich, the former CEO of Norwest Corporation and, later, Wells Fargo, allegedly invented the strategy while at Norwest. Under Kovacevich, Norwest encouraged branch employees to sell at least eight products, in an initiative known as "Going for Gr-Eight". Joint checking accounts are an effective way for couples, parents and children, and business partners to manage money together, and the one you pick will depend on your circumstances.

Make sure you look at all the features including interest rates, fees, ATM access, parental controls, minimum balance requirements before selecting an account. You can open anaccount onlinewith SDCCU in just a few easy steps. You can transfer funds from an existing SDCCU account, with your credit or debit card or from a checking or savings account at another financial institution. You'll just need your account number and the bank routing number of the bank account you are transferring from. You can also enroll in text banking to get Wells Fargo bank account information in seconds.

Key Features Details Minimum Deposit $25 Access to Your Checking Account Online, mobile, over the phone and at physical branches. Security FDIC insurance up to the maximum amount allowed by law. Fees $3 monthly fee, waivable with online-only statements This Teen Checking account is available to teens from 13 to 17 years old. The account will need to have an adult co-owner, although both parties will have equal access to the account.

Plus, monitoring the account is made easy for both parents and teens with account alerts, online access and mobile banking. Parents can set limits on purchases and withdrawals to help their children learn about responsible spending. Account holders will also have access to My Spending Report with Budget Watch which works to help customers develop budgeting skills with free money management tools.

All of the accounts included on this list are FDIC-insured up to $250,000. Note that the interest rates and fee structures for brick-and-mortar savings accounts are subject to change without notice. Product and feature availability vary by market so they may not be offered depending on where you live. Most brick-and-mortar banks require you to enter your zip code online for the correct account offerings. Any return on your savings depends on the associated fees and the balance you have in your brick-and-mortar savings account.

To open a savings account, most banks and institutions require a deposit of new money, meaning you can't transfer money you already had in an account at that bank. To come up with the best joint checking accounts, we compiled a list of the most popular choices and researched more than a dozen accounts. We considered banks that were entirely online and those that had brick-and-mortar locations. We reviewed the monthly maintenance fees and minimum balance requirements, weeding out those with high fees or onerous minimums. We also assessed other important account features, such as the availability of free checks, ATM fee rebates, and Zelle payments. To earn the high rate in any given month, you have to make 15 or more debit card transactions and have at least one direct deposit to hit your account.

In addition, you'll need to sign up for electronic statements and sign in to online or mobile banking at least once each month. Complete all of these and you'll see an interest payment at the end of that month equivalent to 3.30% APY on your daily balance. However, miss just one requirement and you'll earn zero that month. Opening a joint checking account with your tween or teen is an excellent way to help them learn how to bank wisely, as you track their account activity for teaching money moments. Wells Fargo Everyday Checking is Wells Fargo's most popular account for day-to-day banking.

We also considered factors such as insurance policies, users' deposit options, other savings accounts being offered by the same bank and customer reviews when available. With a little shopping around and choosing an account that meets your expected banking behavior, you should be able to avoid almost all fees on a joint checking account. One set of options will be those accounts with no monthly maintenance fee and no minimum balance requirement. Checking accounts are bank accounts designed for frequent transactions, such as writing checks, making debit card purchases, paying bills, and sending money to other people. A joint checking account is simply one that allows for two account holders to share the funds and have access to the same account. The account's perks extend beyond the account itself, too.

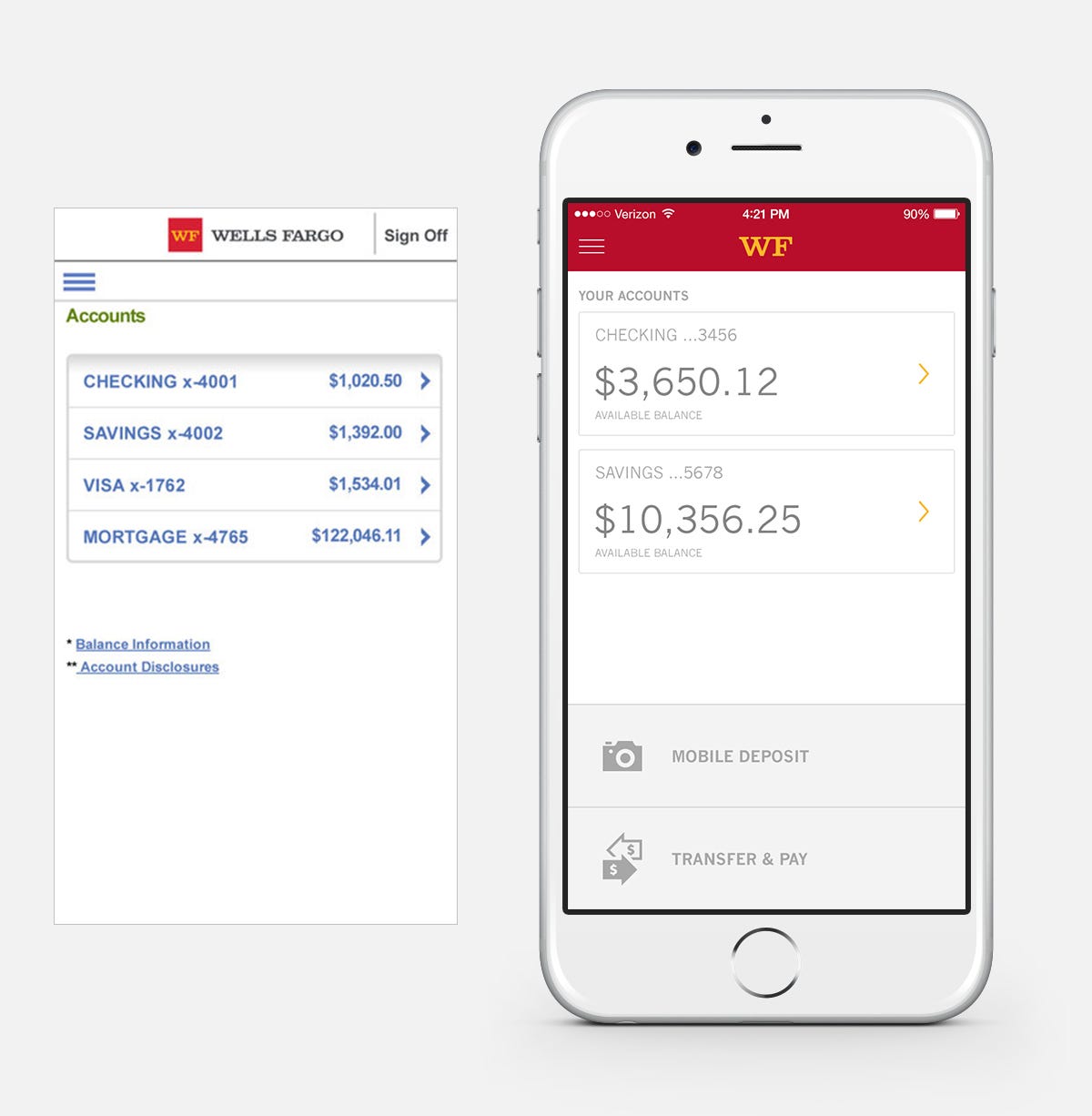

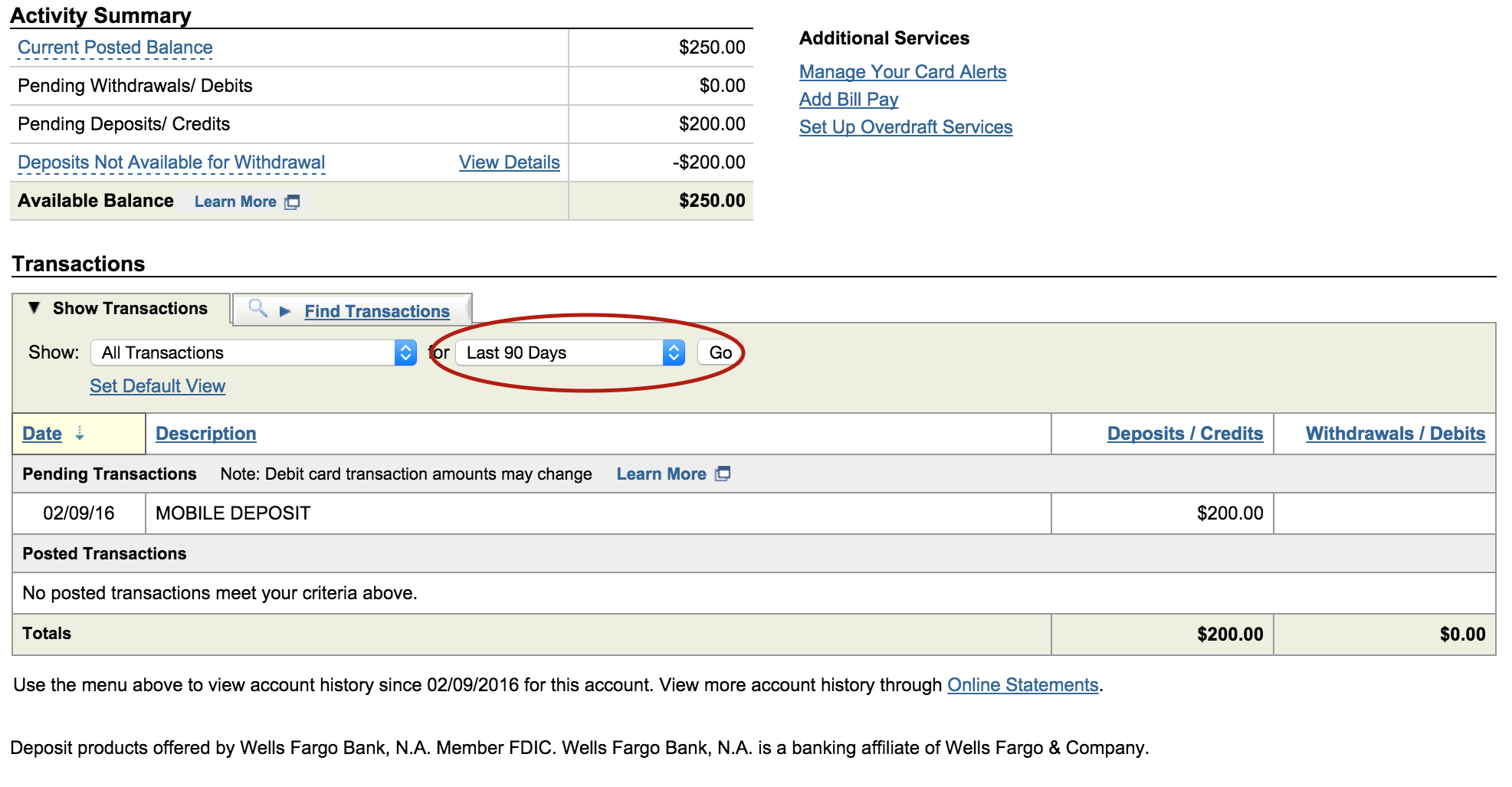

All of the Wells Fargo business checking accounts provide access to online and banking tools, which include mobile check deposit, online bill pay, text banking and digital wallet capabilities. These tools allow you to customize account and user access, set up alerts and even turn your cards on and off. If you send money to someone who isn't enrolled with Zelle, they will receive a payment notification prompting them to enroll with Zelle.

After your intended recipient enrolls, it may take between 1 and 3 business days for your recipient to receive that payment in their bank account. This is a security feature of Zelle designed to reduce risk and protect you whenever you're sending or receiving money. Once that payment completes, that recipient will be able to receive future payments faster, typically within minutes. Once you're a customer, you can easily log into your account online using your username and password. When you use your mobile app, you can deposit checks and even request an ATM code to use at a Wells Fargo ATM in lieu of your debit card. This checking account is for customers with substantially higher account balances.

While a high balance isn't required to keep your account, it allows you to earn at a higher interest rate and have the account's high monthly fee waived. Account balances of $250,000 or more also waive fees for incoming wires, stop payments and ExpressSend remittance services, and receive unlimited reimbursement for non-Wells Fargo U.S. ATMs . The account comes with access to Wells Fargo Mobile app, a debit card with chip technology, budgeting, cash flow and spending tools, online bill pay and 24/7 customer service. Account holders also have access to the Zelle peer-to-peer payment platform.

Need to pay a friend for your share of dinner or rent? There are several easy ways to send money to somebody without writing a check or digging for exact change. Most banks offer services for making person-to-person payments, while other services simply act as a front-end to access your bank account. But don't overlook the accounts that charge a monthly fee but make it easy to waive. For instance, if you can count on receiving at least one direct deposit paycheck every month, this will enable you to avoid monthly fees on many checking accounts.

Similarly, if you're confident you can keep $500 or $1,000 in your joint checking account at all times, this will waive the monthly fee on another group of accounts. The best joint checking accounts offer features such as debit card usage, check-writing ability, ATM access, online bill payment, and more. These accounts can easily be accessed by their account holders on the go and offer competitive interest and low or zero fees. In online banking, you will first need to add an account.

From within any account, select the Transfer Money icon and choose Add An Account. Once the account is added and confirmed, it can be used for transfers. You can set up same day/future dated/recurring transfers in either online banking or the mobile app. Employees also created fraudulent checking and savings accounts, a process that sometimes involved the movement of money out of legitimate accounts. The creation of these additional products was made possible in part through a process known as "pinning". By setting the client's PIN to "0000", bankers were able to control client accounts and were able to enroll them in programs such as online banking.

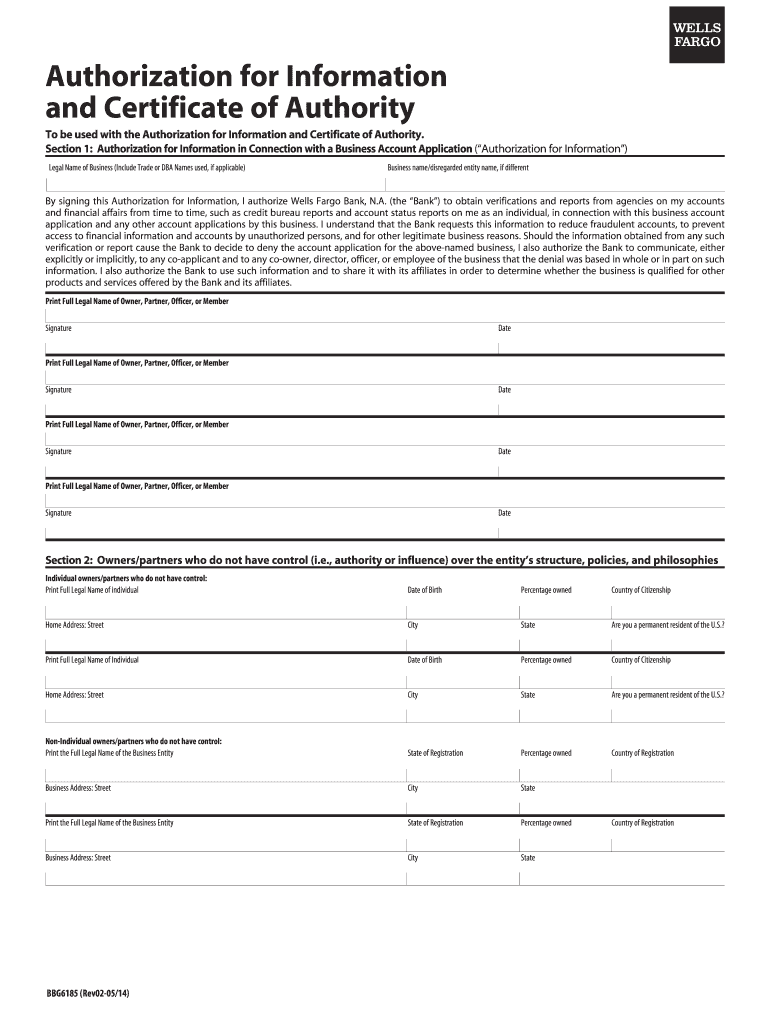

These types of monthly fees are not uncommon, but there are both brick-and-mortar and online competitors that can offer fee-free account options. For personal accounts, you will need to provide your Social Security number, email address and phone number to enroll in Online Banking. You will also be asked to verify your enrollment using either your ATM/CheckCard Number and PIN, or a Customer Number .

To send money in minutes with Zelle®, you must have an eligible U.S. Bank account and have a mobile number registered in your online and mobile banking profile for at least three calendar days. Transactions between enrolled consumers typically occur in minutes and generally do not incur transaction fees. Generally, we will attempt to withdraw the funds for your bill payment two times. You may be charged Overdraft Fees or Returned Item fees for each payment attempt and an Extended Overdraft Fee if your account remains overdrawn for five business days. Refer to the Schedule of Fees and Charges for your respective checking account for more fee information.

Fees may be avoided by ensuring you have the available funds to cover your bill payments and any other outstanding transactions or by setting up Overdraft Protection. With its Rewards Checking account, it makes it possible for checking account customers to earn between 1% cash back on their debit card transactions. When you make this a joint account and arm each account holder with their own debit card, the cash back rewards can really add up. Axos' generous ATM fee reimbursements are what earn it our top spot for couples with frequent ATM use, and the refunds are available with all of their checking accounts. It features no monthly maintenance fee, no minimum balance, no ATM fees , and not even any overdraft fees.

An added bonus is its Direct Deposit Express feature, which allows you to get your paycheck deposit up to two days early. Opening a joint bank account with Ally is quick and simple and is handled almost entirely online. While there are no brick-and-mortar branches you can visit, customer service is easy to access via a phone call or live chat, available both in the app and via online banking. Wells Fargo provides a pretty well-rounded banking experience for its customers. You have a wide variety of bank accounts to choose from, alongside credit cards, auto loans and more.

So whether you want a simple savings account, a Special CD or a checking account for your teenage daughter, you can find that here. When you bank with Wells Fargo, you'll have access to a ton of features that make banking more convenient. For starters, you'll be able to bank in person at about 13,000 Wells Fargo ATMs and more than 6,000 branches. When you're unable to bank in person, you can use both Wells Fargo Mobile® and Wells Fargo Online® to bank from your home and while on the go.

Whether online or in person, you'll be able to send and receive money, pay bills, set up account alerts and more. The Wells Fargo mobile banking app was recently updated to give users the option of selecting Spanish as their preferred language. The move will make it easier and more convenient for Spanish-speaking customers to view account balances, transfer funds between accounts and deposit checks from their smartphones. As an example, Bank of America's entry-level account, Business Advantage Fundamentals Checking, offers up to 200 fee-free transactions per month, with each additional transaction costing 45 cents.

Plus, Bank of America does not charge an excess transaction fee for ACH transfers, debit card transactions, electronic debits and mobile or online check deposit. To add funds to your account, you can use merchant card deposits, ACH transfers, wire transfers, mail checks, mobile check deposits, as well as visit a Wells Fargo branch or ATM. You can add your Wells Fargo business debit card to your digital wallet, enable text banking and customize user access on your account.

Turning off your card is not a replacement for reporting your card lost or stolen. Contact us immediately if you believe that unauthorized transactions have been made. Turning your card off will not stop card transactions presented as recurring transactions or the posting of refunds, reversals, or credit adjustments to your account. Any digital card numbers linked to the card will also be turned off.

For debit cards, turning off your card will not stop transactions using other cards linked to your deposit account. For credit cards, turning off your card will turn off all cards associated with your credit card account. Availability may be affected by your mobile carrier's coverage area.

Your mobile carrier's messaging and data rates may apply. Enrollment in Wells Fargo Online® Wires is required, and terms and conditions apply. Applicable outgoing or incoming wire transfer service fees apply, unless waived by the terms of your account.